- Inbound/ Email Client questions and confirmation of cut-off time

- When does the wire need to be completed?

- What type of wire do they need: A Regular Wire Transfer or a Closeout Wire Transfer?

- Provide the client with the cut-off times and fees

- When contacted via phone or email, CX provides the client with the wire form and wire agreement form through a secure message

- CX must follow Email Procedurebelow when a wire request comes through email

- Reply to the client’s email with Instructions Sent through OLB – Wire Request email template

- Send a secure message using the Wire Request pipeline and provide wire documents and instructions

- See the email procedure below for the full process

- If the client does not have OLB proceed with an email message

- CX must send the client a new secure message if the wire request comes in through any other pipeline that is not the Wire Request pipeline through WebAdmin

- See the email procedure below for the full process

- CX must follow Email Procedurebelow when a wire request comes through email

- Verify the account used for the wire transfer

- Verify funds are available

- Double-check pending transactions

- Restrictions/holds need to be cleared to move forward

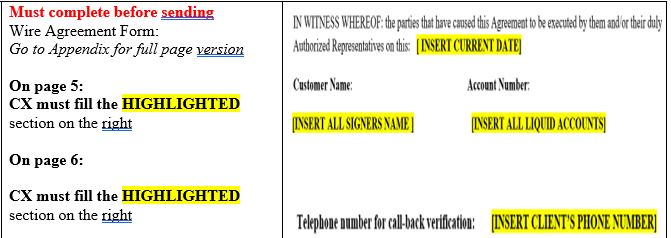

- CX team needs to MODIFY the Wire Agreement form with the client’s information

- A color copy of a valid government-issued I.D. is needed to complete all wire requests

- Quontic Bank wire fees

- Closeout Wire: No Fee (receiving bank may charge a fee, ACH is a free option)

- Domestic Wire Fee: $25.00

- Foreign Wire Fee: $35.00

- Incoming Wire Fee: No Fee

- Quontic Wire cut-off times:

- Foreign – cut-off time is at 12:00 PM EST

- Domestic – cut-off time is at 3:00 PM EST

- Incoming Foreign/Domestic Quontic Bank Information Needed

- Address

- 3105 Broadway, Astoria, NY, 11106

- 800-908-6600

- 021473030

- NORHUS33

- Address

- Incoming Foreign/Domestic Quontic Bank Information Needed

- Closeout Wire Transfer Form

- NO signature

- NO wire agreement form required

- Complete their own Closeout Wire Transfer Form

- Agent must NOT fill out the form for the client

- Following documents are required if the funding account is NOT the originating funding account

- Bank Statement and Color copy of your valid government-issued I.D.

- Closeout wire must be sent to one of the account owners’ account

- Closeout wire can NOT be sent to another recipient

- Regular Wire Transfer FormWet Signature is Required- If unable to print and sign, ask DBO to send a DocuSign form to complete (last resort)

- A Wire Transfer Agreement is needed for all first-time wire transfers

- Account List must include liquid accounts, DO NOT include CD account

- The Wire Department saves these forms; see step 13 to view saved Client Agreement Forms

- Joint account:

- If only Joint Signer A signs the form, then only Joint Signer A can do wire transfers on the account.

- If the second joint signer did not sign that form; that joint signer needs to sign a new agreement

- NOT Mandatory to have both signatures on the wire agreement form

- These forms do not expire

- DBO calls the client before sending the wire to verify the information on the wire

- NO modifications once DBO verifies the wire with the client

- The client can ask to RECALL the wire; however, there is no guarantee of retrieving the funds

- BIG PICTURE: DBO uses the ID and wet signature to verify the customer

- Wire Transfer time frame

- Domestic Wire: Appear in the receiving account the same day or the following business day

- Depending on the receiving bank

- Foreign Wire: These wires can take 1- 15 business days to show on the foreign account.

- Dependent upon the policies and procedures of the receiving bank

- Domestic Wire: Appear in the receiving account the same day or the following business day