A payoff letter is a document that is prepared by Quontic that shows how much money a borrower must submit to fully pay off a loan.

Rules and Restrictions

- A Payoff Request Form must be completed by the borrower and received by Quontic before we send the borrower their Payoff Request Letter

- Payoff Request Form requires a Wet Signature

- A Payoff Request letter is a document that is prepared by Quontic upon receiving the Completed & Signed Payoff Request Form

- Pay-off Letters are valid for 15 Calendar Days (including weekends and public holidays) from the date of letter.

- If the loan is not fully satisfied by the good-through date mentioned in the initial payoff request, the borrower will need to submit a new pay-off request to obtain the updated payoff amount. This ensures that the payoff amount is accurate and reflects any additional interest or charges that may accrue beyond the initial date specified.

- There is no fee incurred to request a payoff letter

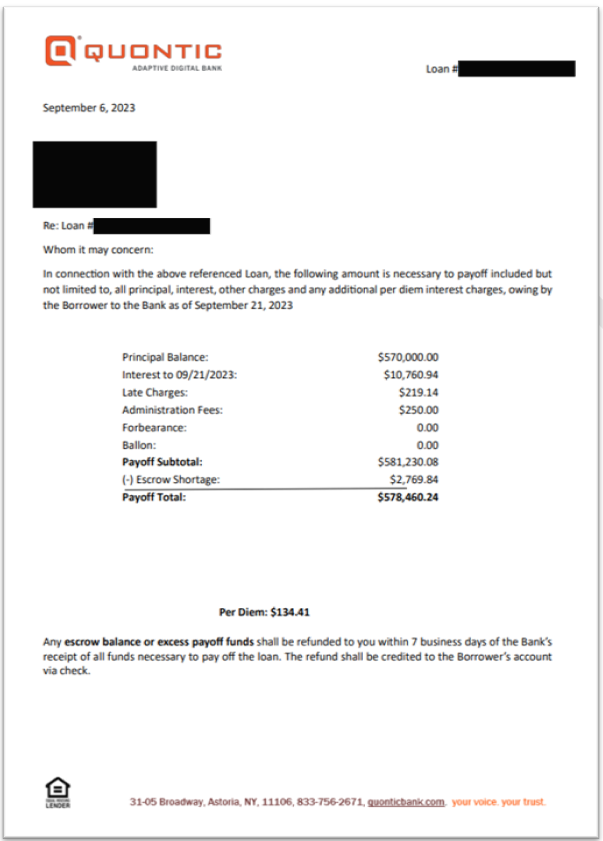

Payoff Letter will include the following amounts:

- Principal Balance

- Interest

- Late Charges

- Administration Fees

- Forbearance

- Ballon

- Payoff Subtotal

- Escrow Balance

- Available Escrow balance is deducted from the payoff subtotal

- Payoff Total

- Daily Interest Per Diem

- Good through date

- Ways to pay

Ways to Pay

- Check Payment

- Wire Payment

Check payment Instructions

If the full or partial payment is made by certified check or cashier’s check, please be sure to add three (3) additional business days of interest to account for mail delivery

Payoff Wire Instructions

- Quontic Bank, 3105 Broadway, Astoria, NY 11106

- Account# 9997 9997 01406425

- Routing# 021-473-030 Loan#

- Ref: Loan Payoff

If paying by wire, the wire must be received by 6:00 PM (EST) on the specified date

Payoff Request Form

Payoff Letter Example

Payoff Request by 3rd Party Title Company

- Title Company must send a written request to the payoff team (email accepted) along with a Third-Party form (Payoff Authorization Form)

- This form must be completed by the borrower

- The title company provides this form to the borrower

- Turnaround time is 1-2 business days for the request to be completed.

- Email address to provide to the 3rd party is [email protected]