BACKGROUND:

Quontic performs routinely reviews on existing accounts transactions to ensure banking products offered are used as intended. A series of transactions under the Cash Rewards product were identified as manufactured spending. Instead of purchasing traditional goods or services to meet the necessary cash rewards thresholds, there are Person-to-Person (P2P) transactions qualifying for cash rewards. In February 2023, Quontic determined to close these accounts (in accordance with the account closing provision contained in the Deposit Account Agreement) as the intent or purpose of the terms and conditions of the account was not met.

The Customer Success team responsibilities include:

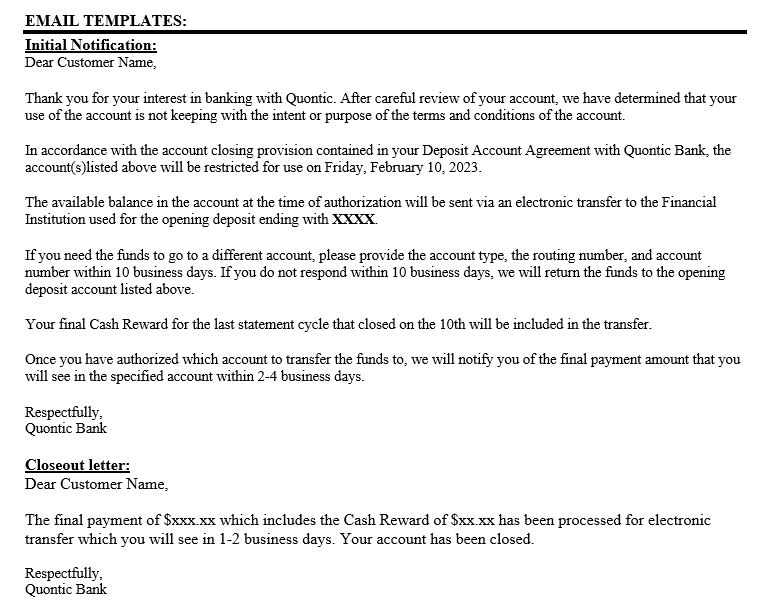

- Sending the initial and final written notification of account closure to the Cash Rewards customers

- Complete the request by the due date when it is provided

- Use the provided template for the initial notification and the final account closure amount

- Send the notification through Online Banking and to the email address on file

- Correctly updating the final closure template with the correct amount of the processed ACH the same day the ticket is re-assigned to the CX Team

- Submit the ticket to the DBO Close Account Request as High Priority

- Subject Line: High Priority – CashReward Closeout- NAME

- Escalate to manager once talking points have been utilized and the customer is still unsatisfied

TALKING POINTS:

“The account was intended to payout a Cash Reward for using the card for merchant point of sale transactions. Your account was generating rewards based upon moving money which was not in the intention. Therefore we have exercised our right to close the account, in accordance with the account closing provision contained in the Deposit Account Agreement.”

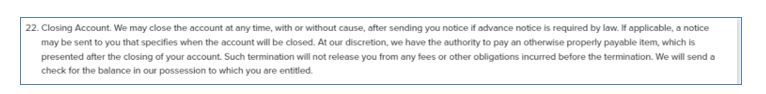

“Your Deposit Account Agreement can be found at the following link https://www.quontic.com/quontic-bank-disclosure-required-by-federal-law/ and disclosure number 22.”