- Access Horizon XE

2. Locate the client’s account in Horizon XE

3. Click on Relationship Summary

- Click on Customer Accounts

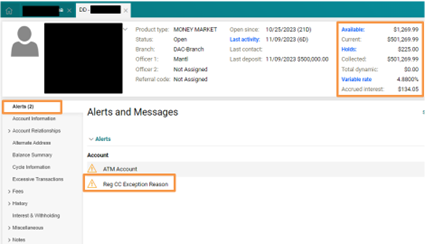

- Verify the Current Balance vs the Available Balance

- If both balances match there is no hold on the account

- If both balances do not match there might be a hold or a pending transaction on the account

- Verify the Current Balance vs the Available Balance

- Click on the account in question

4. CX will be defaulted to the Alerts Tab under the Alerts section

- If CX sees Reg CC Exception Reason under the Alerts section its due to a hold on a check deposit

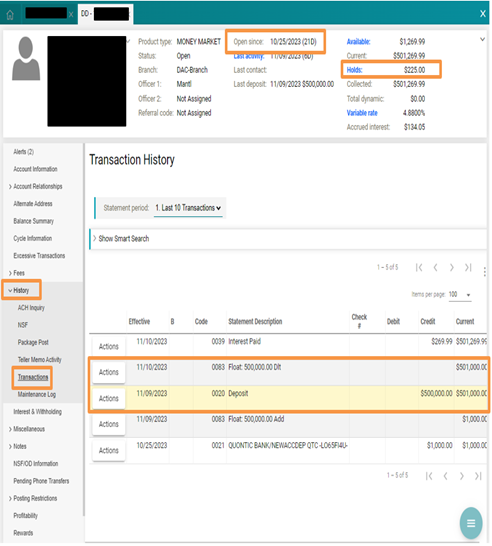

5. Click on History

- Click on Transactions

- Verify when the transaction was completed and how long the account has been opened for

- Accounts opened less than 30 days – all mobile deposit checks are placed on a 9-business day hold — NO EXCEPTIONS

- Accounts opened more than 30 days — the client will receive $225.00 after one business day of the deposit, the client will receive $5,300 after two business days of the deposit, and the remaining balance after the seventh business day of the deposit

- Mobile checks can be placed on an extended hold upon DBO discretion — DBO will send the client an email to advise of the extended hold — Refer to the Receipt from Quontic Bank ticket located in the client’s Hubspot Contact Profile

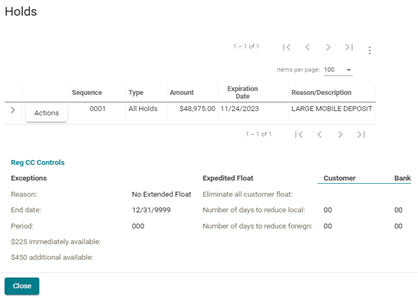

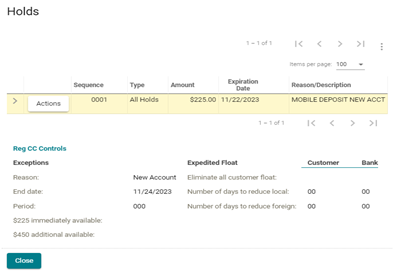

- CX must click on Holds on the upper right-hand corner to view more information on the hold

6. CX will be provided with more information on the mobile deposit:

- Sequence Number

- Type of Hold

- Amount of the Hold

- Expiration Date of the Hold

- Reason of the Hold

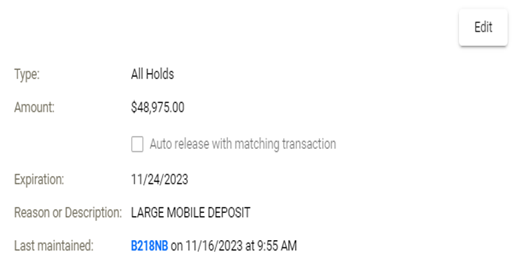

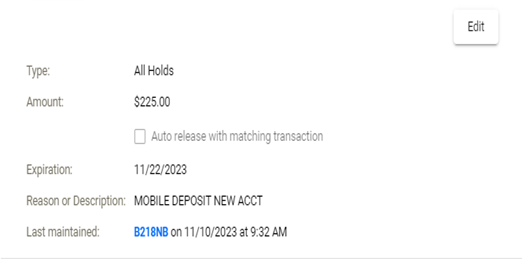

CX can click on the arrow to see when the maintenance was done on the mobile deposit

Large mobile deposit hold example: